The Solihull Property Blog: A weekly update – week one 2023

Happy New Year to you, and welcome to the first edition of the Solihull Property Blog! The year’s first blog post looks at the UK market house price forecast whilst providing statistics from the Solihull market over the last seven days.

HEADLINES

- Estate Agents reduce large numbers of homes to stop clients from moving agencies.

- House price drops are predicted throughout the year.

- Solihull property sellers need to become realistic regarding pricing.

UK Market Commentary

Mortgages

According to the Bank of England, the number of new mortgages for house purchases decreased significantly in November, falling to 46,100 from 57,900 in October. This marks the lowest level since June 2020 and could be a sign of slowing demand in the market. Additionally, approvals for remortgages also went down in November, falling to 32,500 from 51,300 in October.

However, despite this decrease in new mortgage activity, the Bank of England’s latest Money and Credit statistics show that net borrowing of the mortgage debt by individuals increased from £3.6 billion to £4.4 billion in November. This suggests that while fewer people may be taking out new mortgages, those already have them continue to borrow.

Transactions

Looking at the broader market, data from the House Buyer Bureau Index reveals that the number of property transactions falling after last year’s Mini-Budget was the highest recorded in five years, at an estimated 90,188 in Q3 2022. This marks a 15.6% increase every quarter and a 3.6% uplift compared to the same period in the previous year. The rising inflation and increasing house prices have also pushed the average cost of a failed property transaction to £3,337, leading to an estimated total cost of almost £301 million for homebuyers and sellers in Q3 2022.

House prices dropping

In contrast to these reports of slowing demand and failed transactions, Nationwide’s latest survey shows that UK house prices fell for the fourth month in December, marking the longest run of declines since 2008. The annual growth rate also slowed significantly, to 2.8% in December from 4.4% in November, with all regions affected. The average property price dropped by 0.1% month on month to £262,068, which is 2.5% lower than the August peak after accounting for seasonal effects.

Investment market

Finally, the Telegraph has published an article suggesting that 2023 could collapse the buy-to-let market in the UK. Rising mortgage rates and a ceiling on rents are reportedly threatening the viability of property investment, with many landlords selling up or raising rents in response. Some have even cited the combination of reduced tax relief and high mortgage costs as having “completely killed the private buy-to-let market.” I fear this perspective is slightly sensationalist. With tenant demand at an all-time high in Solihull, our landlords receive multiple applications for each property. Rent caps would damage the sector, but this is unconfirmed.

Overall, it’s clear that the UK’s residential property market is facing several challenges and uncertainties. Various factors are at play, from slowing demand and falling prices to rising costs and failed transactions. As always, it’s important for potential buyers and investors to carefully consider their options and assess the risks before making any decisions. We’ll provide independent advice over the next few months regarding the market and how to navigate it. It’s not all doom and gloom, so stay positive if you’re moving home in 2023!

The Solihull market

A vital feature of the Solihull Property Blog is the local market conditions. We feel Solihull has it’s own micro conditions which need accurate reporting. Overall, the property markets in the B90 and B91 postcodes have seen a mix of new instructions and price reductions in the year’s first week. These results are expected, with agents seeking to reduce houses to generate new interest and stave off their clients from serving them notice for lack of activity. The detached home market in the B90 postcode saw the lowest number of new instructions and the highest number of price reductions. In contrast, the detached home market in the B91 postcode saw the highest number of new instructions and a smaller number of price reductions. The semi-detached home markets in both postcodes saw an average number of new instructions and price reductions.

The B91 postcode also saw a new instruction for a bungalow. The average prices for new instructions in the B90 and B91 postcodes were £556,666 and £849,990 for detached homes, £340,900 and £580,000 for semi-detached homes, and £325,000 for a terraced home in the B90 postcode. Overall, the average prices for homes in the B90 and B91 postcodes were £407,522 and £726,663, respectively. It is important to note that these market updates only reflect a snapshot of activity in the first week of the year and may not accurately represent the market as a whole. Below is each postcode in further detail:

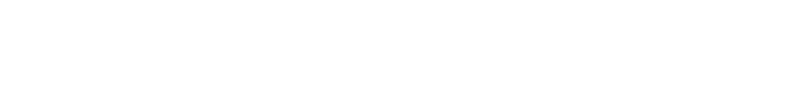

B90 market

In the first week of the year in the B90 postcode, there were twenty-two new instructions for properties, with fourteen properties experiencing price reductions. Detached homes had the lowest number of education, with only three properties coming onto the market and seven existing detached homes experiencing price reductions. The average price for a new instruction for a detached house in the B90 postcode was £556,666.

Semi-detached homes saw a slightly higher number of new instructions, with five properties coming onto the market; eight experienced price reductions. The average price for a new instruction for a semi-detached home in the B90 postcode was £340,900.

Terraced homes had the lowest number of new instructions, with only one property coming onto the market. This property experienced one price reduction with an asking price of £325,000.

Overall, the average price for a home in the B90 postcode was £407,522.

Click HERE to view the B90 properties on Rightmove.

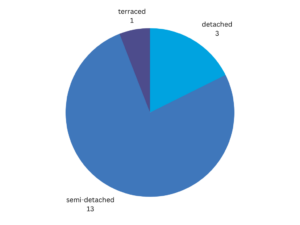

B91 market

Semi-detached homes saw fewer new instructions, with two properties coming onto the market. Existing properties experienced three price reductions. This type had an average asking price of £580,000.

There was also a new instruction for a bungalow in the B91 postcode, with an asking price of £750,000.

Overall, the average price for a home in the B91 postcode was £726,663.

Click HERE to view the B91 properties on Rightmove.

Sign up for the Solihull Property Blog by filling in the form below. We’ll provide free advice on buying and selling your home in Solihull throughout the year. Additionally, you’ll receive industry updates and key developments.

Need more advice on buying in 2023? Click the link for our advice HERE.